Unusually Options Activity

Before making any options trade, it’s a good idea to learn about the terminology.

Calls at the Ask: Bullish indication

Calls at the Bid: Bearish indication

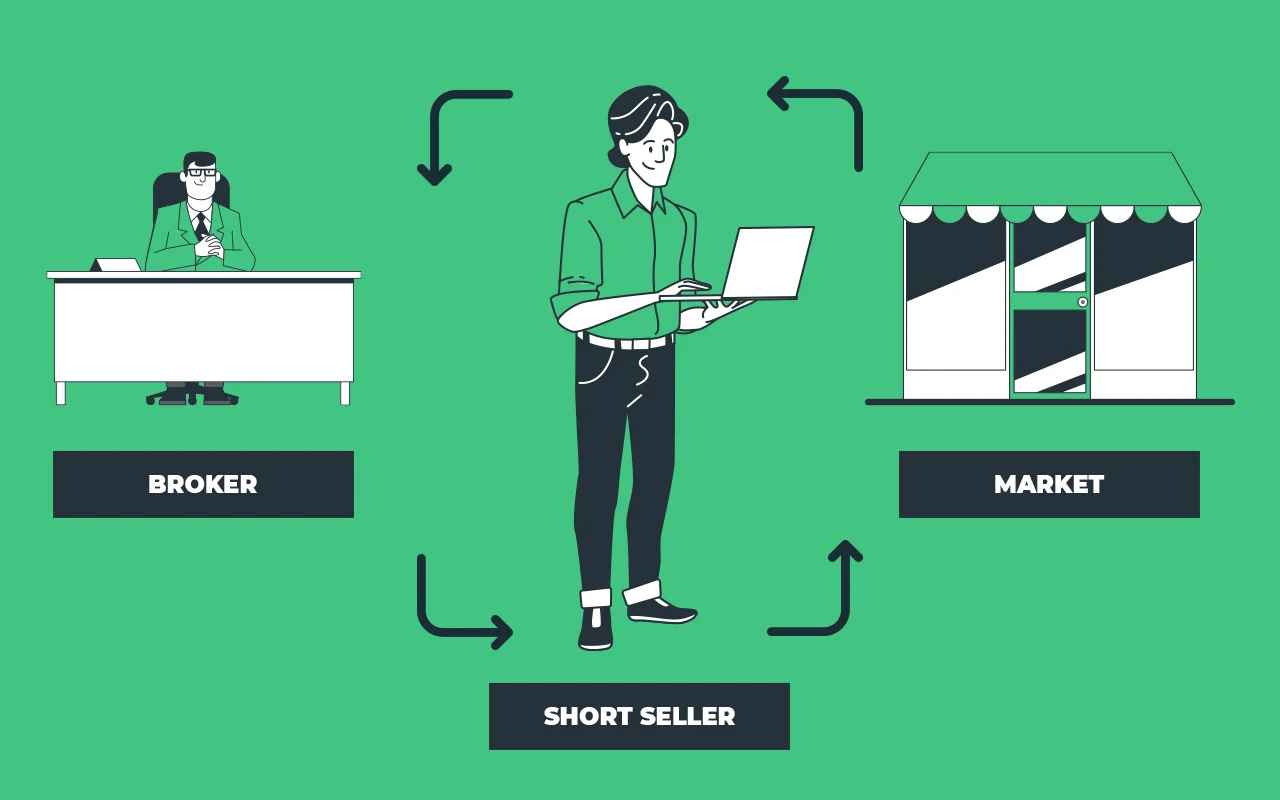

Market Sweep: Sweepers that move quickly are tactical. They stay incognito, splitting orders across multiple exchanges concealing their true order and size.

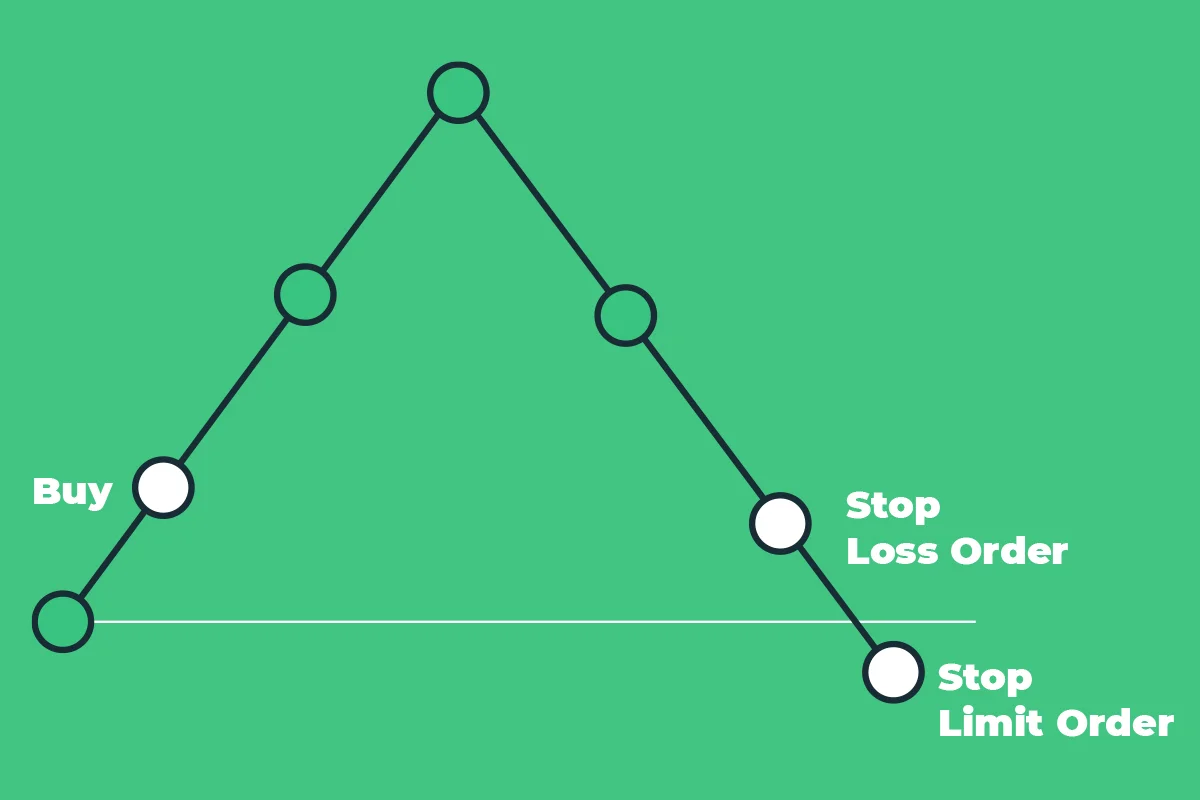

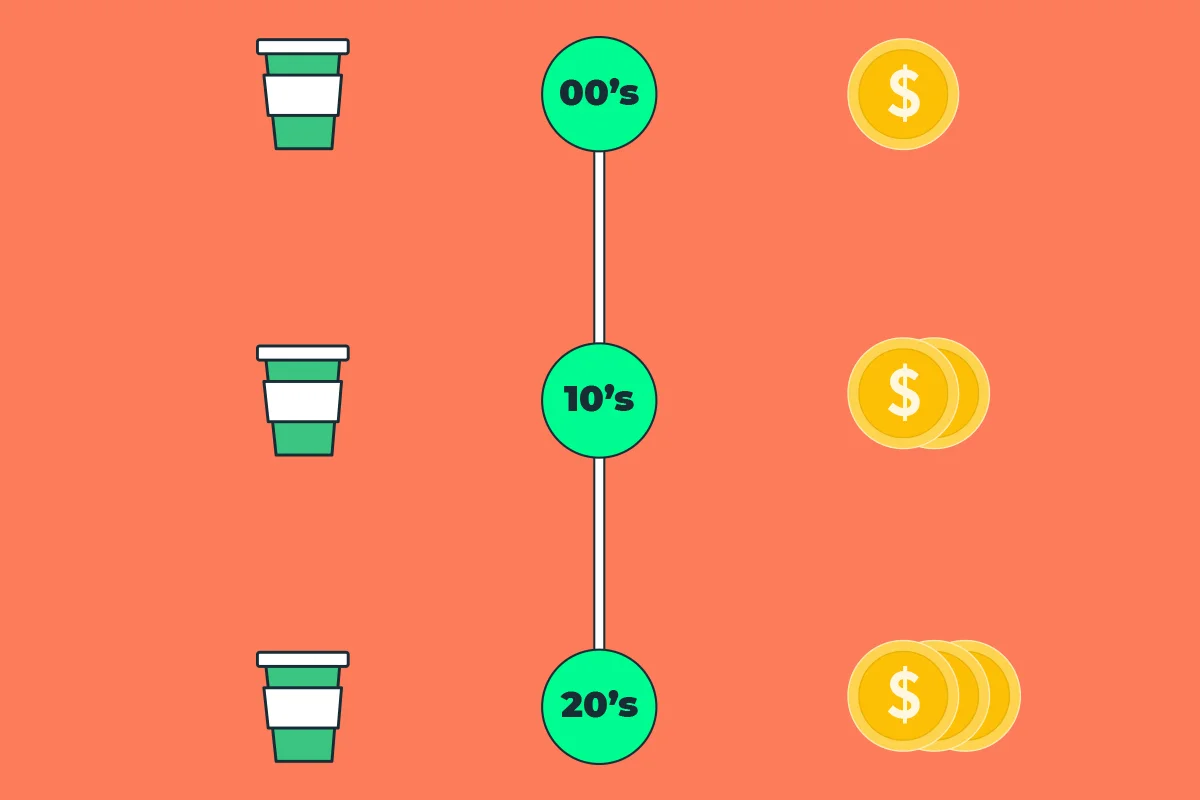

It's important to remember the market sentiment and how that relates to the underlying asset. Another important clue is the current contract size traded versus the total daily volume. In addition, the trade count could show a potential change in the short-term direction.

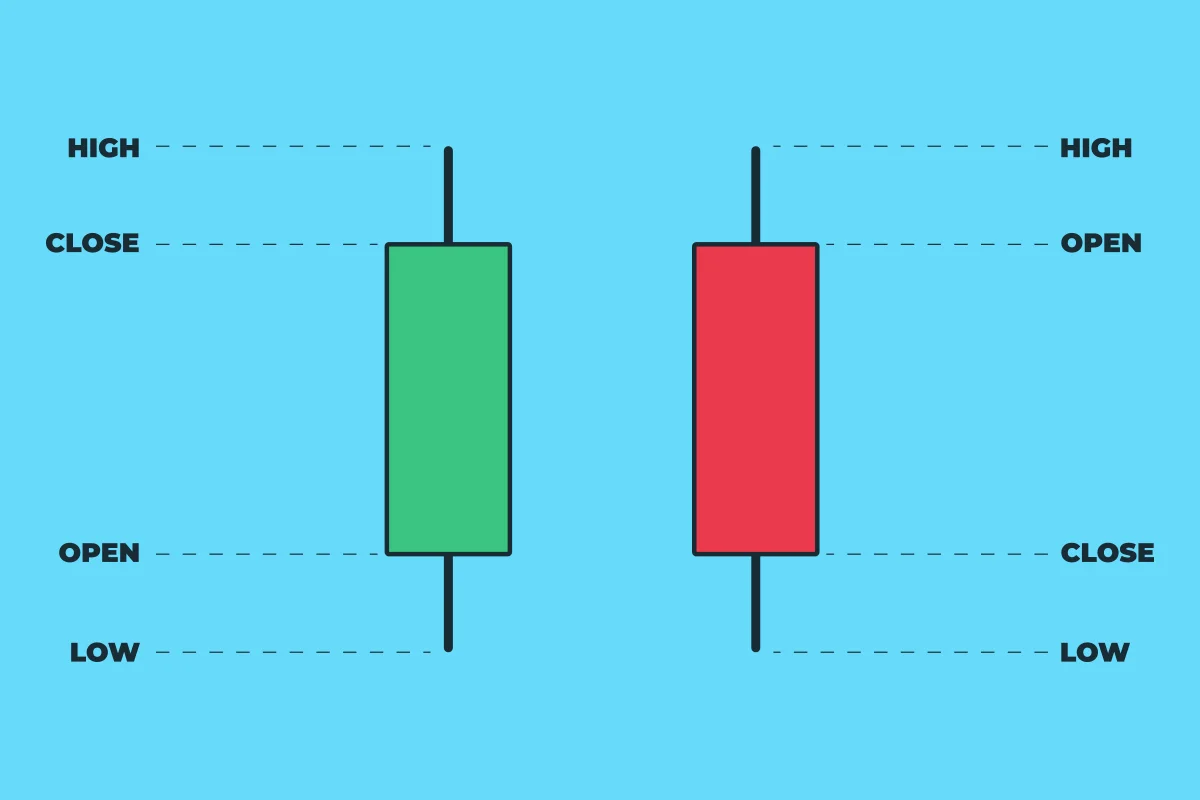

Profitable traders focus on various strategies. They also focus on statistics. Terms like delta, premium, strike price, and extrinsic value. These are concepts options traders are most concerned about.

In addition, it is important to understand how in or out-of-the-money options affect price action.